Accounting: Principles of Financial Accounting by IESE Business School. Certification link.

- The Balance Sheet a summary of all the sources of capital and uses of capital in the company.

- The Income Statement explains the profitability of the business.

- The Cash Flow Statement explain the generation and consumption of cash in the business. give information about the liquidity of the business.

- Accrual Accounting

- More

Financial Accounting : Record, Classify, Summarize. (objective : provide information to external users that is useful in making resource allocation decisions) (Required Reading):

graph LR subgraph FIRM["Firm"] direction LR ECO["Economic events

in the firm"] --> FA["Financial Accounting :

Records, classfies &

summarization in financial

statements"] end AUD["Auditors (examining and verifying)"] --> FIRM AP["Accounting principles (e.g. IFRS, US GAAP)"] --> FIRM FA --> EU["External users: - Current and potential investors. - Creditors (banks, suppliers,...) - Customers - Government agencies - Employees and trade unions - Competitors"]

Business Circle:

graph LR FI["Financing raise capital"] --> IV["Investing capital in long-term resources"] IV --> OP["Operations make profits by operating efficiently"] OP -- "Rewards capital providers" --> FI OP -- "reinvest part of profits" --> IV

1. The Balance Sheet

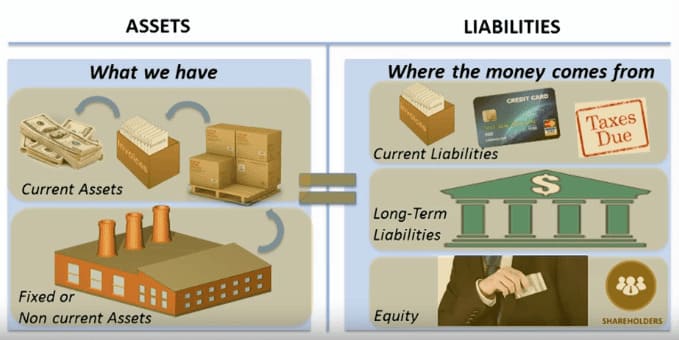

Balance Sheet : the statement of finanial position. Double Entry Accounting : Use of capital (Assets) == Source of capital (Equity & Liabilities).

- Assets = Liabilities + Owner’s Equity

- Current/Non-Current Assets/Liabilities.

- Assets : ordered by Liquidity.

- Equity & Liabilities : ordered by Maturity Date.

- Working capital.

Assets : a) resources owned or controlled by the firm, b) that are expected to generate future economic benefits and c) arise from a past event or transaction.

- Examples : machine(y), brand(n), employees(n), lottery(n), sport club employee(n/y).

- Current (cash or expected to convert into cash) & Non-current (intend to use for a long period of time to conduct its operations).

Liabilities : a present obligation of the firm to transfer economic benefits in the future to another party that arise from a past event or transaction.

- Examples : bank loan(y), loss a lawsuit but cannot estimate the penality(n - unknown amont), sell car with warranty (y).

- Current (to be paid in less that one year or the firm’s operating cycle) & Non-current (obligations of the firm that will be paid in more than one year).

Owner’s equity is the wealth of the owners in the firm : a) the capital contributed by them and b) the earnings generated by the operations and retained in the firm.

2. The Income Statement

The income statement (the statement of profits and losses (the P&L)) is a financial statement that measures the performance of the firm over a period of time. It shows the profit generated and its different components. The income statement contains the revenues generated (the achievements) less the expenses incurred (the efforts). (Required Reading)

- Revenues – Expenses = Net Profit. (not the change in cash during the period)

- Revenues are increases in owners’ equity as a result of operations conducted by the firm with the intention of generating profits.

- The firm has done all that it has promised to do for the customer。

- The firm has received cash or some other asset.

- Expenses are decreases in owners’ equity as a result of operations conducted by the firm with the intention of generating profits.

- The consumption of an asset results from a transaction that leads to the recognition of revenue.

- The consumption of an asset (or the incurrence of a liability) results from the passage of time (e.g., depreciation expense, interest expense).

- The profit and loss account.

- Profitability != Liquidity

- Loss of value over time. Depreciation (折旧) (for tangible non-current assets) and Amortization (摊销) (for intangible non-current assets).

- Interest from Bank Loan and Taxes.

- Other Comprehensive Income (OCI).

| Income Statement (Expenses by Function) |

|---|

| Sales revenue - Cost of goods sold expense |

| Gross profit (revenue - cost of sales/services) - Marketing and selling expenses - Administration expenses - Research & development expenses - Other operating expenses +/- Other nonrecurring operating items |

| Operating profit (revenues - operating expenses) (earnings before interest and taxes (EBIT)) + Financial income - Financial expense |

| Profit before tax - Tax expense |

| Net profit from continuing operations (all the revenues - all the expenses) - Profit for minority interests |

| Net profit for parent company owners |

T-account (debit 借记, credit 贷记):

| Assets | Liabilities and owner's equity | ||

|---|---|---|---|

| Beginning balance Increases debit (Dr.) + |

Decreases credit (Cr.) - |

Decreases debit (Dr.) - |

Beginning balance Increases credit (Cr.) + |

| Ending balance | Ending balance | ||

3. The Cash Flow Statement

The statement of cash flows shows how cash is generated and how cash is used in every period and it classifies the different cash flows into three categories: cash from operations, cash from investments and cash from financing. (Reading)

- Financing cash flows include capital contributions by owners, new borrowings, repayment of existing borrowings, and payment of dividends.

- Investment cash flows include purchases or disposals of property, plant and equipment, purchases or sales of financial assets (i.e., shares of other firms, treasury bills, etc.), and purchases or disposals of other firms (i.e., mergers and acquisitions)

- Typically involve the acquisition and disposal of long-term assets and investments.

- All other cash flows are operating cash flows, which include collections from customers, payments to suppliers and employees, payments to tax authorities, and payments for operating expenses (i.e., rent, insurance, utilities, etc.). Interest paid or received and dividends received from financial investments.

- Involve the primary revenue-generating activities of a company and include transactions related to the sale of goods and services as well as expenses necessary to run the business.

4. Accrual Accounting

Accrual accounting recognizes revenues when the firm sells goods or performs services; at the same time, it also recognizes the expenses incurred to generate the revenues.

- The economic impact of events and transactions is recognized in the financial statements when the events and transactions occur, not when cash exchanges happens.

- Cash Accounting (when cash exchanges), miss any economic event not reflected in the cash account yet.

- Examples : 50% salary in the middle of the month, prepaid insurance, accrued interest and advances from customers.

Accrual accounting matches revenues with the expenses associated with those revenues, allowing for better forecasting and decision-making. It also incentivizes long-term investments and provides a more comprehensive view of the company’s financial position.

One disadvantage of accrual accounting is that it requires making estimations, such as depreciation, which can be subjective and prone to errors or manipulation. Cash accounting, on the other hand, provides a calculation of real cash inflows and outflows.

5. More

Advanced accounting topics.

- Inventory valuation.

- Bad debts.

- Provisions for sales returns and warranties.

- Financial assets.

- Impairments of non-current assets.

- Long-term debt : bonds.

- Leases.

- Owners’ equity transactions.

- Corporate taxes.