Foundations of Business Strategy Coursera, Certification link.

- Strategic Analysis : the strategic analysis and the SWOT, competitor, and environmental analysis tools and then apply these tools in the Google case study.

- Analyzing Industry Structure : how to assess an industry’s structure and how the competitive dynamics in an industry affect profitability. We’ll go into depth with the five forces tool, a common and highly influential analytical framework.

- Analyzing Firm Capabilities examine the tangible and intangible assets that form an organization’s strength.

- Determining Competitive Position use an easy and intuitive tool–strategy maps–to visually communicate information about firm positioning.

- Final Assignment

1. Strategic Analysis

Business strategy produces the major policies and plans for achieving a company’s goals.

1.1 Structure

graph TD SM[" Strategic Mission A firm's values and purpose and the scope of its operations in product and market terms. "] SP[" Strategic Plan How a firm positions itself in the market and develops and leverages internal resources and capabilities to accomplish its strategic mission. "] SA[" Strategic Actions Individual actions taken to execute the strategic plan in pursuit of the strategic mission. "] SP --> SM SA --> SP

Strategic Analysis: the assessment of an organization’s current competitive position and the identification of valuable competitive positions in the future and how to achieve them.

- From a generalist perspective (integrative, foundational).

- Using strategic reasoning (rivalry, dynamics, complexity).

- Grounded in analytics and data.

- Applying appropriate tools and frameworks.

1.2 Strategist’s Challenge

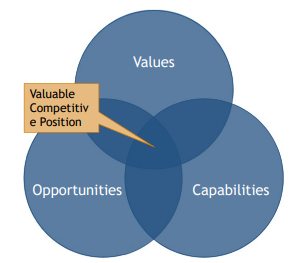

The Strategist's Challenge: balancing values, opportunities, and capabilities to identify the desirable competitive positions that create and sustain value.

- Values - What are the values of the organization, i.e. the values, the mission, the scope of the organization.

- Mission Statements defines who a company is and what it’s trying to achieve, which is the foundation of its strategy.

- Goolge, Dell, Citigroup, etc

- Opportunities - market value, market demand, space.

- Capabilities - competitive advantage.

1.3 Market Inefficiency & Opportunities

Fundamental Principle of Business Strategy : "if everyone can do it, it's difficult to create and capture value from it." or "In a perfectly competitive market, no firm realizes economic profits (rents)"。

- Rents : Accounting Profit & Economic Profit

- Accounting Profit (subtracting only operating costs).

- Economic Profit (subtracting both operating and opportunity costs) (replacement value).

- Measure Economic Profit:

- Tobin’s Q: ration of a firm’s market value to its asset replacement value (hard to require knowledge).

- Discounted Cash Flow (DCF) : measure value of firm going forward. Discount rate relects return to equity. Net present value.

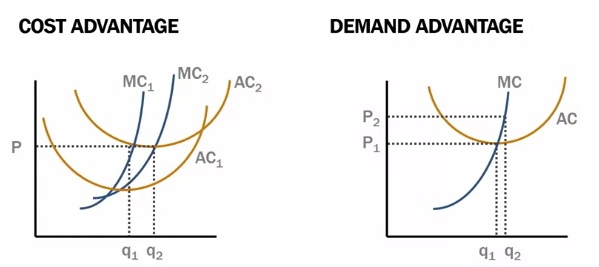

- Firms in a competitive market are price takers, meaning they charge the prevailing market price.

- Price should equal marginal cost (the cost of one additional unit).

- Profits = Revenues - Variable Costs - Fixed Costs. $\pi= P_{1}q_{1} - c(q_{1}) - c_{f}$

- $\partial\pi / \partial q_{1} = 0$ leads to $P_{1} - c’(q_{1}) = 0$, $P_{1} = c’(q_{1}) \triangleq MC$ : Marginal cost.

- The existence of economic profits suggests some type of market inefficiency and our task as strategists is to identify ways in which firms may capitalize on these market imperfections.

- Perfectly competitive markets are exceedingly rare.

- Two perspectives on Rents: (how firms achieve superior performance)

- Monopoly Rents (Industrial Organization View) : Barriers to entry; Industry structure matters.

- Ricardian Rents (Resource Based View) : Barriers to imitation; Firm structure matters.

- The role of the strategist is then to identify these potential sources of competitive advantage.

1.4 Tools

- SWOT Analysis : Strengths, Weaknesses, Opportunities, Threats.

- Competitor Analysis. performance metrics, capabilities, objectives/value, strategy.

- Environmental Analysis. Demographic Trends, Socio-Cultural Influences, Technological Developments, Macroeconomic Impacts, Political-Legal Pressures, Global Trade Issues.

2. Analyzing Industry Structure

Five Forces Analysis focuses on the structure of an industry and how the competitive dynamics of that industry affect the profitability potential for firms in that industry.

(1) Threat of Entry. Entry is less likely when :

- Entrant faces high sunk costs (沉沒成本 costs cannot be recovered).

- Incumbents (現任) have a competitive advantage. (patents & licenses, pioneering brands, pre-commitment contracts, large economics of scale, steep learning curves, etc)

- Entrant faces retaliation (by strategic behavior of incumbents).

(2) Threat of Substitutes. (similar product but not exactly the same - butter and margarine).

- Cross-Price Elasticity : perfectly elastic, moderately, perfectly inelastic.

- Switching costs: (apple ios <-> android)

(3) Bargaining Power of Buyers. buyers have less power when:

- Buyers are not concentrated (no monopsony).

- Buyers have few options:

- Differentiated product

- High switching costs (relationship-specific assets)

- Buyer cannot backward integrate (向本業之上游(供應商)整合, e.g. Walmart & Coca-Cola).

- Buyers are segmented - Price Discrimination:

- 1st degree : to maximize willingness to buy.

- 2nd degree : self-sorting. Airlines will price their tickets to different types of consumers differently.

- 3rd degree : sorting by groups. Bundling.

(4) Bargaining Power of Suppliers. Suppliers are less of threat when :

- Sellers are not concentrated (no monopoly).

- Firms have many alternatives.

- Sellers may not treat segments differently. (price information widely available)

(5) Intensity of Rivalry. less intense when :

- Small number of competitors ?

- Incentive to “fight” are low: Substantial market growth; Opportunities to Differentiate; Low exit costs; Little excess capacity.

- Coordination is feasible (tacit coordination).

Others : Role of Complemnets, Role of Institutions.

3. Analyzing Firm Capabilities

Barriers to imitation - Cost Advantage. v.s. Demand Advantage.

The Value Chain - Resources to Capabilities (describes all the steps necessary to bring a product to market): (1) analyzing capabilities is use the value chain to articulate the capabilities of the firm; (2) unpack those capabilities by understanding the people, processes, and systems that under-ride the ability to deliver those capabilities.

| Tangible | Intangible | |

|---|---|---|

| People Assets | Cash, Physical Plant, Patents, Talent | Brands, Reputation, Technical Expertise, Loyalty |

| Systems Processes | Contracts/Alliances, IT Systems | Positive Culture, Talent Acquisition |

Alignment of capabilities both internally and externally.

Sustainability of Advantages captured and sustained.

- Imitability. legal barriers present; control scarce (稀缺) supply; unique historical path; socially complex (Disney); tight combinations (Facebook); credibly commitment.

- Durability. assets degrade; rigidities; obsolete as time change, selling assets.

Building Capabilities: (1) Acquired from others (require imperfect market); (2) Develop internally (needs know-why or know-how).

4. Determining Competitive Position

Generic Competitive Positions:

| (Low) Cost Source | Uniqueness Source | |

|---|---|---|

| Broad Scope | Cost Leadership | Differentiation (Brand, Innovation, Human resources) |

| Narrow Scope | Focused Low-Cost (often used as entry strategy) | Niche (premium group) |

Integrated Strategies, offering differentiated products at low cost. Example : Toyota, Southwest Airlines.

Strategist’s Toolkit: Strategy Maps

Question to ask:

- What favorable strategic opportunities exist?

- How contested is a position ?

- New markets (Blue Ocean Strategy)

- Existing markets (Red Ocean Strategy)

- Can we establish this competitive position ?

- Do we have the capabilities to execute ?

- Can we create value in unique ways versus established competitors?

- Can we defend this position once established ?

- Sustainability, Evolution?